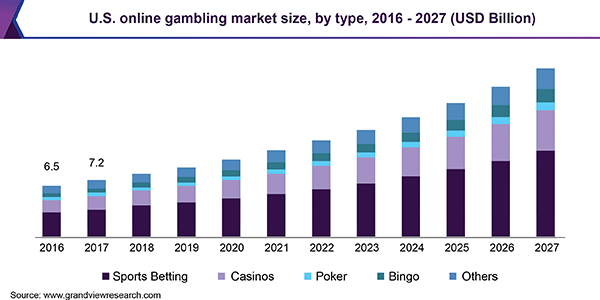

Online gambling has quickly become one of the most popular markets in the world. The industry is seeing an increase in volume flowing through it with each passing quarter and 2022 will be no different. According to Grand View Research, the online gambling market is expected to reach $127.3 billion by 2027. More than $500 million was spent betting on Super Bowl LV.

The industry can be split into two distinct categories – casino betting and sports betting. The modernization of technology has revolutionized the way the industry generates revenue, moving from land-based casinos to online and mobile experiences. It’s an undeniable shift in consumer behavior that has only been accelerated by the global pandemic and growing digital landscape.

2022 offers exciting growth potential for the stocks in this industry. Here’s why we should be looking at the digital transformation as an opportunity rather than a setback.

Sports Betting Is Here To Stay And 80% Takes Place Online

Sports are a universal way for us to connect and involve ourselves in a community. The desire to speculate on and potentially profit from our passions is growing. Millennial behavior has shown their appetite shifting away from traditional gambling, and into sports betting.

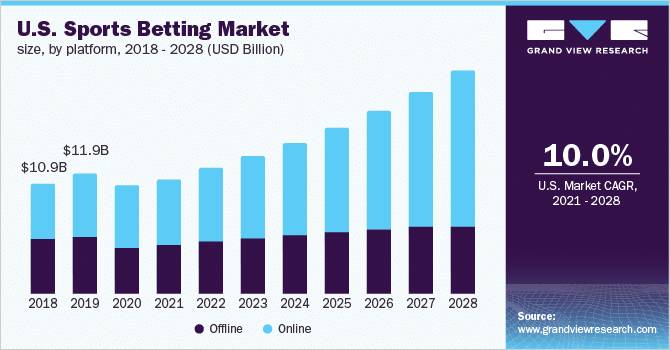

It’s already a huge market, and it’s only getting bigger. About $160 billion worth of bets are made on sports each year, with online bookmakers taking almost 80% of that figure. Once a largely niche activity, the digitization of betting has driven the market forward to huge growth. The ongoing legalization of sports betting across states in the US has allowed for this exponential growth.

Grand View Research estimates a compound annual growth rate (CAGR) of 10.1% from now to 2028 in the global sports betting market. We may not be able to pack Vegas casinos full of gamblers amidst the Omicron breakout, but we can be confident that sports enthusiasts are placing their bets on sites like DraftKings and Barstool Sports.

Casino Stocks Are Quickly Adapting

Casino stocks are rapidly expanding their online gambling offerings. Other companies tangential to the industry are doing the same to capitalize on growing demand.

These companies recognize that the online and mobile market participants crave a dynamic gambling environment. iGaming companies are introducing new and engaging games to appeal to younger generations. Penn National (PENN- NDAQ), offers a mobile application with slots and table games. BetMGM (MGM – NYSE) – offers the same, with additional games that further socialize the gambling process.

DraftKings (DKNG – NDAQ) is stirring up the competition by offering traditional table games like poker, blackjack, and baccarat on DraftKings Casino. They see the lucrative opportunity of online gambling outside of just sports.

According to Mordor Intelligence, the online gambling market is expected to register a CAGR of 11.49% during the forecast period, 2021-2026.

COVID-19 has caused turbulence for the lives of many. Our growing digital addictions have a number of downsides too. However, these two factors have positioned and allowed the gambling industry to expand online in an expedited manner. Companies in the industry and their stock prices will likely reflect that growth in the years to come.

As of 1/25/2022, the top 10 holdings of the fund are, FLTR LN, LVS, MGM, PENN, EVO-SS, SGMS, KAMBI-SS, CZR, 9672-JP, TAH-AU. They can be viewed here iBET Sports Betting & Gaming ETF (IBET) – Inherent Wealth Fund

References:

https://www.grandviewresearch.com/industry-analysis/sports-betting-market-report

https://www.investors.com/news/draftkings-stock-leads-gambling-transformation-new-casino-stocks-next-generation-take-over/

https://www.mordorintelligence.com/industry-reports/online-gambling-market

https://www.grandviewresearch.com/industry-analysis/online-gambling-market