Gambling has a long and storied history that stretches back almost as far as our knowledge of the past. Today, there are more ways than ever to place a wager, and the advent of the Internet has created even more avenues for people to bet against the house or each other. Sports betting is at the forefront of the gaming sectors currently experiencing the biggest booms in popularity.

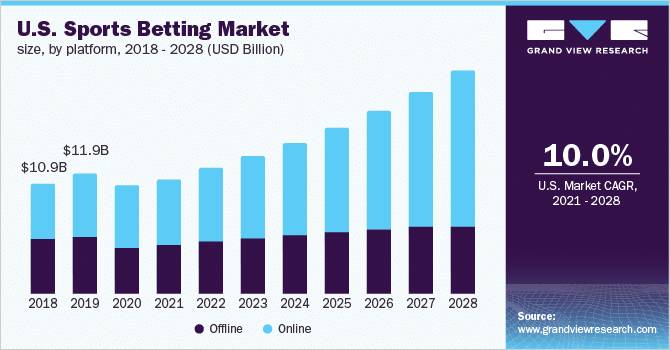

Not only has wagering on sports games because a popular activity in many nations worldwide, but many companies have also sprung into existence looking to capitalize on this trend. This industry expansion has led to the proliferation of many new gambling stocks as these businesses go public and seek to attract investors. What do you need to know about sports betting in the digital age, and should you consider investing in these businesses?

The Basics of Today’s Sports Wagering

There aren’t many differences between what you can experience online versus the experience you’d have visiting a legal sportsbook. The types of bets are the same; for example — players can make money line wagers, take over/under bets, bet the point spread, and more. The platform automatically pays out the player should they make a winning wager. However, a key difference is the opportunity to offer unique “proposition” style bets with short wagering windows — an exciting way to create opportunities for fun while also bringing in additional revenue beyond pre-game betting.

Sports betting is just one aspect of the digital gaming and entertainment industry. Like real-life casinos, some locales also allow web users to access online “table games” such as blackjack, slot machines, and even poker such as Texas hold’em. Increasingly, some companies have chosen to consolidate all these services under one roof. Others continue to focus strictly on sports betting primarily.

Why Are Online Betting Businesses Interesting Investment Opportunities?

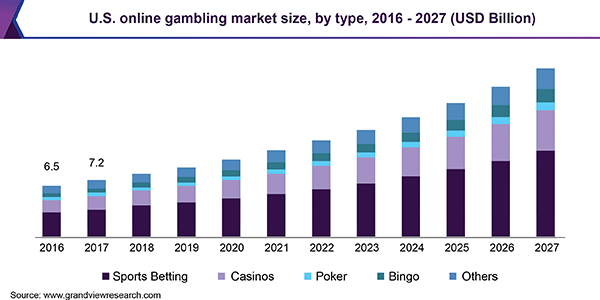

Online gambling businesses show strong year-over-year growth in regulated markets. By expanding beyond the requirement for bettors to visit a physical location to place a bet, the potential to grow user bases on a massive scale is clear. The creation of unique, new wagering products also positions many of these businesses favorably in terms of the value proposition they provide.

Red Rock Resort sportsbook director Chuck Esposito said on the surge in betting.

“Overall, I think the general acceptance of sports wagering is a big part of it,” he said. “The increased volume on both in-play (betting) and props; the continued growth of mobile; the restrictions on masks lifted; the 100 percent occupancy compared to 50 percent last year; and the willingness industry-wide to take higher limits.”

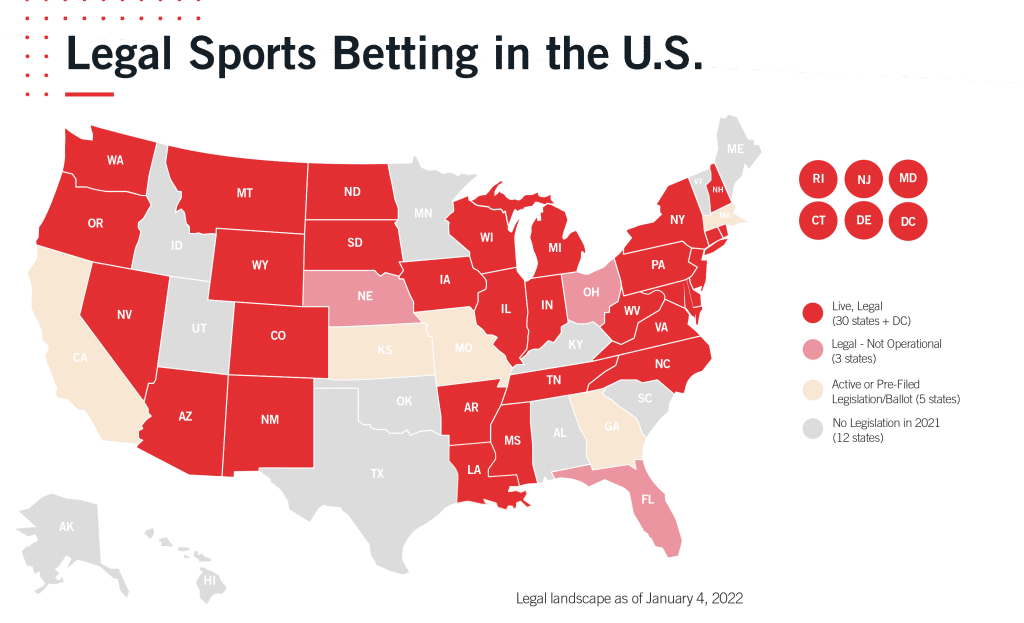

The trend in many locales is towards additional regulation and legalization of activities, including online sports betting, rather than instituting other restrictions. This potential for future growth and reaching currently untapped markets mean that already-hot gaming stocks could explode in the future. However, regulatory approval is not sure, and in some states in the US, sports betting seemed to have a legal future only for legislators or the courts to reverse course at the last minute.

Considering the Future

Sports betting businesses represent an exciting opportunity with a rapidly expanding market value and a seemingly voracious appetite for wagering services in many markets. When carefully chosen and managed, investments in these businesses could lead to short or even perhaps appreciable long-term gains. However, the uncertain regulatory environment, especially the patchwork legislation in the United States, should factor into your risk calculations. Consider exploring the different gaming businesses available and tailor your investments to your preferred profile.

Penn National Gaming Inc. (NASDAQ: PENN)

Penn National Gaming Inc. (NASDAQ: PENN)

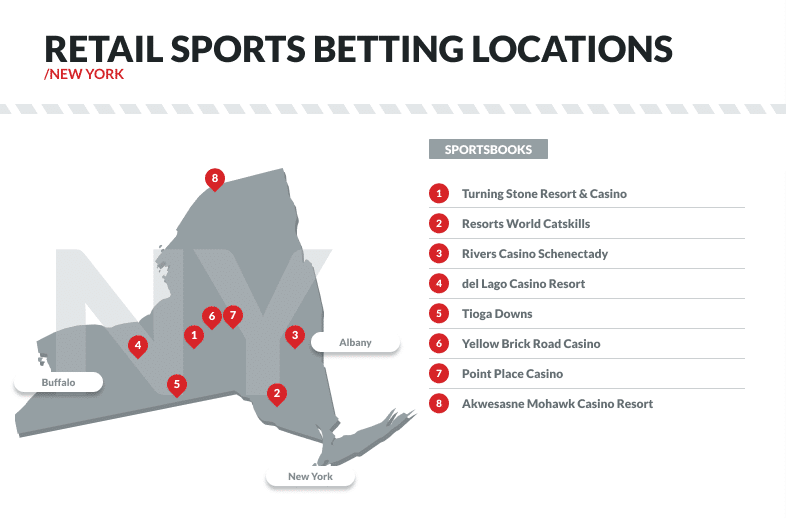

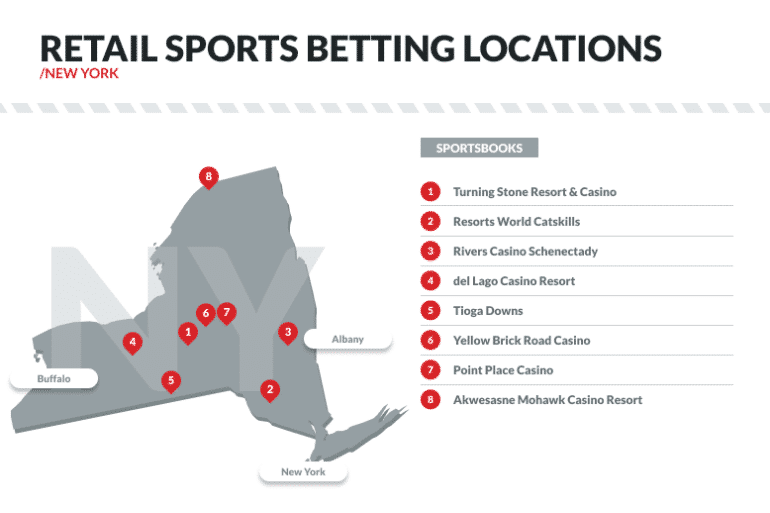

The New York Gaming Commission announced on Thursday 01/06/2022 that legalized online sports betting is coming to New York. New York became the 18th state to legalize online sports betting, making it available to its 20 million-plus residents. On Saturday 01/09/2022 at 9 am ET, four books launched their services in New York.

The New York Gaming Commission announced on Thursday 01/06/2022 that legalized online sports betting is coming to New York. New York became the 18th state to legalize online sports betting, making it available to its 20 million-plus residents. On Saturday 01/09/2022 at 9 am ET, four books launched their services in New York.